The Evolution of Online Travel Agencies (OTAs)

Early Online Travel Agencies: A Glimpse into the Past

During the late 1990s, a quiet revolution began as the first online travel agencies emerged, fundamentally transforming travel planning. These platforms, though primitive compared to today's standards, introduced an unprecedented concept: side-by-side comparison of flight and hotel prices from multiple providers. This innovation empowered travelers with information previously only available to industry insiders. The initial platforms faced numerous obstacles - from clunky interfaces to consumer skepticism about online transactions - yet they planted the seeds for today's billion-dollar industry.

Many early players were startups operating on shoestring budgets, competing against established brick-and-mortar travel agencies. Their success hinged on two critical factors: creating intuitive interfaces and securing partnerships with forward-thinking airlines and hotels. These trailblazers had to simultaneously educate consumers about online booking while convincing suppliers of the digital marketplace's potential. Their perseverance through technical glitches and consumer reluctance established crucial trust in online transactions.

The Rise of Industry Titans

As the new millennium approached, companies like Expedia and Priceline emerged as market leaders through aggressive expansion strategies. They didn't just sell flights and rooms; they created comprehensive travel ecosystems. By bundling flights, hotels, and car rentals into vacation packages, they offered convenience that resonated with time-starved consumers. Their growth reflected broader internet adoption rates, with each technological advancement opening new possibilities for service expansion.

Technology Transforms the User Experience

The evolution of search algorithms and interface designs dramatically enhanced usability. Suddenly, travelers could filter results by specific amenities, proximity to attractions, or even room views. This precision transformed travel planning from a chore into an engaging activity. The ability to preview hotels through photos and virtual tours helped bridge the trust gap that initially hindered online bookings.

Traditional Agencies Adapt or Fade

The digital revolution forced traditional travel agents to reinvent themselves. Many shifted focus to complex itineraries and luxury travel where personalized service still mattered. Others became digital hybrids, using online tools to enhance their offerings. This adaptation demonstrated the industry's resilience, proving that technology complements rather than replaces human expertise in certain travel scenarios.

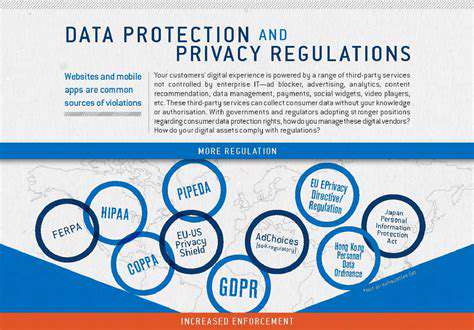

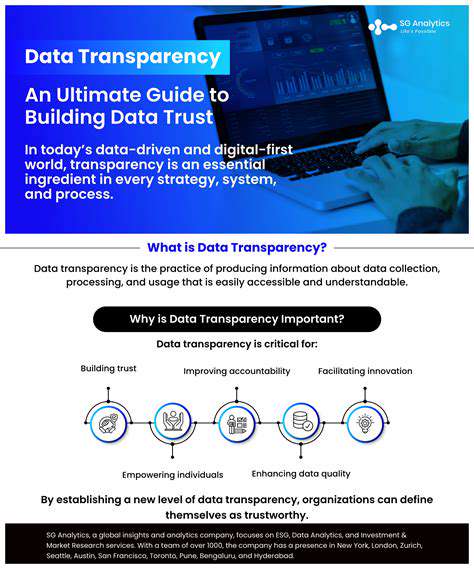

Building Digital Trust

Early platforms invested heavily in security infrastructure to protect sensitive financial data. The implementation of SSL encryption and transparent privacy policies became standard. This focus on security paid dividends as consumer confidence grew, paving the way for today's frictionless transactions. Trust became the industry's most valuable currency, with secure payment processing as its foundation.

Going Global

As internet access expanded worldwide, platforms adapted their offerings for diverse markets. Localization efforts included multilingual interfaces, region-specific payment methods, and culturally appropriate customer service. This globalization presented both opportunities and challenges, requiring platforms to balance standardization with local customization. The result was a more inclusive digital travel marketplace that connected people across continents.

The Rise of Aggregators: Connecting Travelers and Providers

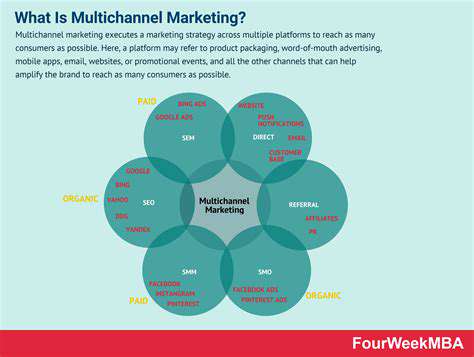

The Aggregator Advantage

Travel aggregators revolutionized discovery by compiling options across multiple suppliers. This one-stop-shop approach saved consumers hours of comparison shopping while giving smaller providers access to wider audiences. The model proved particularly effective in travel, where complexity and choice overwhelm many consumers. Aggregators reduced this paralysis by presenting filtered, comparable options side-by-side.

The benefits flowed both ways. Hotels and airlines gained exposure without massive marketing budgets, while consumers enjoyed transparent pricing. This democratization of access forced providers to compete more aggressively on price and quality, ultimately benefiting travelers. The aggregator model continues evolving, with newer platforms incorporating AI-driven personalization and predictive pricing.

Competition in the Aggregator Age

The rise of meta-search created new competitive dynamics. Providers now compete not just on their own websites but within aggregator rankings. Visibility algorithms became critical business factors, prompting investments in SEO and digital marketing. Some argue this levels the playing field, while others contend it favors large brands with bigger digital budgets. What's undeniable is that aggregators made pricing more transparent, forcing all players to sharpen their value propositions.

Future Challenges for Aggregators

As aggregators grow more powerful, questions emerge about their role as impartial marketplaces. Some face criticism for favoring partners who pay premium placement fees. There's also concern about data ownership and the concentration of market power among a few dominant platforms. Future success may hinge on maintaining user trust through transparency about ranking algorithms and partnership disclosures.

The E-commerce Revolution: User-Friendly Design and Booking Systems

Digital Transformation of Travel Commerce

The travel industry's e-commerce evolution mirrors broader retail trends toward frictionless digital experiences. What began as simple online brochures evolved into sophisticated booking engines with dynamic pricing, instant confirmation, and personalized recommendations. This transformation required complete rethinking of back-end systems to enable real-time inventory management across global partners.

Crafting the Perfect Digital Experience

Modern travel platforms blend aesthetics with functionality. Clean interfaces highlight essential information while progressive disclosure keeps pages uncluttered. Micro-interactions - like subtle animations when selecting dates - provide satisfying feedback that enhances usability. Behind the scenes, machine learning algorithms analyze millions of transactions to optimize everything from search results to checkout flows.

The Mobile Imperative

With most travel research now happening on phones, responsive design is table stakes. Leading platforms employ mobile-first strategies that prioritize thumb-friendly navigation and accelerated mobile pages. Some innovations include voice search for hands-free planning and augmented reality previews of hotel rooms. These mobile optimizations recognize that travel planning often happens in stolen moments between other activities.

Personalization at Scale

Sophisticated data analytics enable platforms to tailor experiences based on past behavior and predicted preferences. A business traveler might see airport hotels first, while families receive kid-friendly recommendations. This contextual relevance boosts conversion while reducing decision fatigue. The challenge lies in personalizing without becoming intrusive - a balance the best platforms manage through transparent data practices.

Security as a Competitive Advantage

In an era of data breaches, travel platforms differentiate themselves through robust security. Features like tokenized payments and biometric authentication protect sensitive information while streamlining checkout. Transparent security badges and clear privacy policies help convert cautious shoppers. Some platforms now offer virtual payment cards for added protection against fraud.

The Last Mile: Fulfillment Excellence

Digital perfection means nothing if real-world experiences disappoint. Leading platforms integrate seamlessly with property management systems to ensure accurate real-time availability. Post-booking communication keeps travelers informed with digital itineraries and proactive alerts. The most advanced systems even predict and resolve issues before travelers notice them, using AI to monitor for potential disruptions.

Read more about The Evolution of Online Travel Agencies (OTAs)

Hot Recommendations

- Senior Travel Discounts and Deals

- Personalized Travel for Different Seasons and Climates

- Honeymoon Destinations: Romantic Getaways for Newlyweds

- Mythical Places: Journeys to Legendary Locales

- The Future of Travel Agents in an Automated World

- Sustainable Design for Tourist Infrastructure

- Combatting Illegal Wildlife Trade Through Travel Awareness

- The Best Beaches for Relaxation and Sunbathing

- Marine Conservation: Diving into Responsible Ocean Travel

- Measuring the Social Impact of Tourism