Preventing Fraud with Automated Booking Security

Identifying Suspicious Activity

Identifying suspicious activity is crucial for maintaining security and preventing potential threats. It involves recognizing patterns and behaviors that deviate from normal operations, often indicative of malicious intent or errors. This can include unusual login attempts, large data transfers, or unusual access requests. Monitoring system logs and user activity is essential for detecting these anomalies. Careful observation and analysis of the collected data are paramount in identifying these red flags, allowing for swift intervention and mitigation of potential damage.

A key aspect of identifying suspicious activity involves understanding the baseline behavior of your system and users. By establishing normal operating parameters, you can more effectively pinpoint deviations. This includes recognizing typical login times, data access patterns, and application usage trends. Knowing what is considered normal is the first step in identifying deviations that may signal malicious activity or errors in the system. Regular review and updating of these baselines is essential to keep pace with evolving operational dynamics.

Preventing Suspicious Activity

Implementing robust security measures is paramount to preventing suspicious activity. This involves a multi-faceted approach to protect various aspects of the system, including user accounts, data access, and network traffic. Strong passwords and multi-factor authentication are critical security controls that can significantly reduce the risk of unauthorized access. Regular security audits and penetration testing can identify vulnerabilities that attackers might exploit.

Proactive measures, such as educating users about phishing scams and social engineering tactics, are also vital. By empowering users with the knowledge to recognize and avoid these threats, you can significantly reduce the likelihood of successful attacks. Regular software updates and patches are also crucial to address known vulnerabilities and prevent exploitation by attackers. Furthermore, implementing robust access controls and monitoring can further deter potential threats.

Best Practices for Suspicious Activity Detection

Implementing robust logging and monitoring systems is essential for detecting suspicious activity. These systems should capture comprehensive information about user activity, system events, and network traffic, providing a detailed record of events. Analyzing this data to identify patterns, anomalies, and potential threats is critical for swift action. Utilizing security information and event management (SIEM) tools can streamline this process, providing centralized visibility into security events across various systems.

Employing security awareness training for employees is another critical best practice. Educating staff about common threats, such as phishing attempts and social engineering tactics, can significantly reduce the likelihood of successful attacks. This training should emphasize the importance of recognizing and reporting suspicious activity, enabling a proactive approach to security. Regular security audits and penetration testing can further strengthen security defenses by identifying vulnerabilities before they are exploited.

Maintaining a Secure Environment

Security is an ongoing process, not a one-time event. Regularly reviewing and updating security policies and procedures is essential to maintain a secure environment. Staying informed about emerging threats and vulnerabilities is crucial to adapt to the constantly evolving threat landscape. This includes staying updated on the latest security best practices and industry recommendations. Continuous monitoring and analysis of security logs and reports are essential for identifying potential weaknesses and improving overall security posture.

Implementing a robust incident response plan is essential for effectively managing and mitigating security incidents. This plan should outline procedures for identifying, containing, and resolving security breaches. Having a well-defined response plan allows for a structured and organized approach to handling security incidents, minimizing potential damage and ensuring rapid recovery. Regular testing and refinement of the incident response plan are crucial to ensure its effectiveness in real-world scenarios.

Beyond Transaction Monitoring: Protecting the Booking Platform Itself

Beyond Basic Transaction Monitoring: Unveiling Deeper Insights

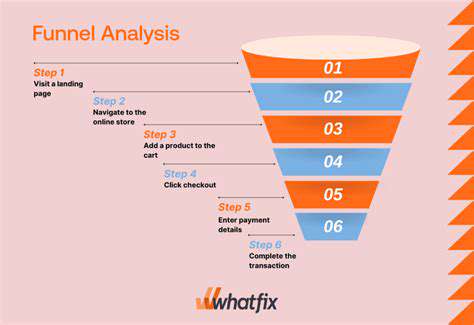

Traditional transaction monitoring often focuses solely on the immediate financial aspects of a transaction, such as the amount, type, and location. While this is crucial for identifying fraud and compliance violations, it misses a critical opportunity to gain a holistic understanding of the underlying context and potential risks. Moving beyond the surface-level details allows for the identification of more complex and sophisticated threats. This broader perspective enables proactive risk mitigation strategies, helping businesses to stay ahead of emerging challenges.

A deeper dive into transaction monitoring requires analyzing a wider range of data points, including customer behavior patterns, account activity history, and external factors like geopolitical events. This comprehensive approach not only detects suspicious activities but also provides valuable contextual information to understand the motivations and intentions behind transactions. This enhanced understanding is essential for effective risk management and empowers businesses to make informed decisions, thereby minimizing potential losses and protecting their reputation.

The Significance of Contextual Analysis

Contextual analysis is paramount in modern transaction monitoring. It's not enough to simply identify a transaction that matches a predefined rule; it's crucial to understand the surrounding circumstances and potential implications. This includes examining the customer's history, the vendor's reputation, and any external factors that could influence the transaction's legitimacy. By incorporating this type of analysis, businesses can significantly improve their ability to detect and respond to complex fraud schemes, potentially preventing substantial financial losses.

Advanced Techniques for Enhanced Monitoring

Advanced techniques, such as machine learning algorithms and behavioral analytics, are rapidly transforming transaction monitoring. These sophisticated methods can identify subtle anomalies and patterns that might be missed by traditional rule-based systems. Machine learning algorithms are particularly valuable in recognizing complex fraud patterns that emerge over time and are difficult to predict through static rules. These techniques learn from vast datasets to identify unusual transaction behaviors, allowing for proactive identification of potential risks.

Furthermore, predictive modeling can be used to forecast future risks based on historical data and current trends. This capability empowers businesses to proactively address potential threats before they materialize, minimizing the impact on operations and financial stability. These cutting-edge tools provide the ability to anticipate and mitigate risk far more effectively than traditional monitoring methods.

Proactive Risk Mitigation Strategies

Implementing proactive risk mitigation strategies based on the insights gained from advanced transaction monitoring is crucial for long-term success. This involves developing policies and procedures that address the specific risks identified, from implementing enhanced security measures to providing targeted training to employees. This approach not only reduces the likelihood of fraud but also strengthens internal controls and improves overall security posture. By actively managing risk, businesses can maintain a strong financial foundation and build trust with stakeholders.

Beyond immediate financial gains, proactive risk mitigation fosters a culture of security awareness and responsibility. This proactive approach creates a more secure environment for both the company and its customers, leading to a greater sense of stability and trust.

The Importance of Continuous Improvement and Adaptation

Continuous Improvement in Fraud Prevention Systems

Implementing continuous improvement in fraud prevention systems is crucial for staying ahead of evolving fraud tactics. This involves regularly reviewing and analyzing system performance, identifying vulnerabilities, and adapting strategies to counteract new threats. A proactive approach to continuous improvement ensures that fraud prevention measures remain effective and relevant in a dynamic threat landscape. This proactive approach requires a culture of data analysis and a commitment to learning from both successes and failures within the system. Regular audits and assessments are essential, focusing not only on the technical aspects but also on the human element, including employee training and awareness programs.

The process of continuous improvement necessitates a feedback loop. Feedback from various sources, including internal stakeholders, external partners, and even fraudulent actors themselves, is invaluable. Analyzing this feedback allows for the identification of weaknesses and the development of strategies to strengthen the system's defenses. By regularly evaluating the efficacy of existing measures, companies can pinpoint areas needing enhancement and tailor their approach accordingly. This iterative process fosters a system that is not static but instead adapts and evolves alongside the ever-changing tactics of fraudsters.

Adapting to Evolving Fraud Patterns

Fraudsters are constantly developing new and sophisticated methods to bypass security measures. Staying ahead of these evolving patterns requires a flexible and adaptable fraud prevention system. This adaptation must encompass a multitude of approaches, including the integration of emerging technologies, the development of innovative detection algorithms, and the implementation of advanced analytics to identify subtle anomalies. The constant learning and adaptation process is vital to maintaining a robust defense against fraud. This constant vigilance ensures that the system can recognize and respond to new patterns as they emerge.

Adapting to new fraud patterns necessitates a constant stream of information. Keeping abreast of industry best practices, emerging trends, and new fraud schemes is critical. This often involves collaborating with other organizations, participating in industry forums, and staying updated on the latest research. By leveraging external resources and internal knowledge, organizations can better understand the evolving nature of fraud and adjust their defenses accordingly. Regular training and education for employees are also essential to help them recognize and report suspicious activity.

The Role of Technology in Adapting Fraud Prevention

Technology plays a pivotal role in enabling continuous improvement and adaptation in fraud prevention. Advanced analytics, machine learning algorithms, and artificial intelligence can be leveraged to identify complex patterns and anomalies that might be missed by traditional methods. These technologies allow for the automation of many tasks, enabling faster response times to emerging fraud threats. Integrating these technologies into the fraud prevention system leads to more accurate detection rates and reduced false positives, saving valuable time and resources. The speed and accuracy afforded by technology are essential for responding effectively to the rapid evolution of fraud.

Moreover, robust data storage and management systems are essential for providing the necessary data for these advanced technologies to function effectively. Data quality and integrity are paramount. By leveraging technology, organizations can create a proactive fraud prevention system that is able to adapt dynamically to new threats, ensuring that the system remains ahead of the curve and effective in the long term. This technology-driven approach is critical to maintaining a robust security posture in today's complex digital landscape.

Read more about Preventing Fraud with Automated Booking Security

Hot Recommendations

- Senior Travel Discounts and Deals

- Personalized Travel for Different Seasons and Climates

- Honeymoon Destinations: Romantic Getaways for Newlyweds

- Mythical Places: Journeys to Legendary Locales

- The Future of Travel Agents in an Automated World

- Sustainable Design for Tourist Infrastructure

- Combatting Illegal Wildlife Trade Through Travel Awareness

- The Best Beaches for Relaxation and Sunbathing

- Marine Conservation: Diving into Responsible Ocean Travel

- Measuring the Social Impact of Tourism