Budgeting for Epic Adventures: A Practical Guide

Identifying Your Dream Destination

Pinpointing the specific location or type of experience that truly ignites your wanderlust is crucial for crafting a truly epic adventure. Whether it's the serene beauty of a remote mountain range or the vibrant energy of a bustling city, visualizing your ideal destination shapes your entire trip. Consider what aspects excite you—culture, wildlife, history, or unique activities. This detailed envisioning allows for smarter budget planning.

Understanding Your Adventure Style

Do you crave solitude or thrive on social interaction? Your adventure style—solo trek, family vacation, or group expedition—significantly influences your budget. A solo backpacking trip costs far less than a family vacation with multiple activities. Knowing your preferences helps allocate resources effectively.

Defining Your Timeline and Duration

The length of your adventure directly impacts costs. A weekend getaway requires less financial commitment than a month-long backpacking trip. Longer trips often allow for cost-effective accommodations and travel strategies that shorter trips don’t. Evaluate your time constraints for realistic planning.

Assessing Your Budget and Resources

Honestly assess your financial resources before researching destinations. Create a clear budget outlining travel, accommodation, food, activities, and emergencies. This avoids overspending and ensures you enjoy your trip without financial stress.

Exploring Accommodation Options

Costs vary widely—hostels, guesthouses, or camping. Hostels offer social interaction and kitchens to cut costs, while camping provides an immersive experience. Weigh priorities to find the best fit for your budget.

Identifying and Prioritizing Activities

Prioritize activities that matter most. Free options like hiking or local markets balance costly guided tours. This ensures maximum enjoyment without breaking the bank.

Building an Emergency Fund and Contingency Plans

Unexpected situations—flight delays, medical emergencies—require a safety net. Build an emergency fund and develop backup plans for transportation or accommodations. This ensures peace of mind during your adventure.

Crafting Your Budget: A Step-by-Step Approach

Understanding Your Income

A thorough understanding of your income is the foundation of budgeting. Include all sources—salary, side hustles, investments—to create a realistic plan. Regular updates ensure accuracy as your financial situation evolves.

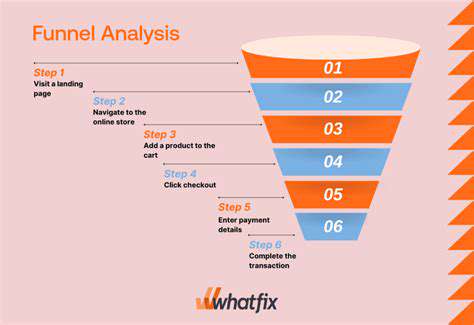

Identifying Your Expenses

Track every outflow, from rent to occasional costs like car repairs. Differentiate needs (rent, groceries) from wants (dining out) to prioritize spending. This clarity improves financial health.

Creating a Budget Template

A structured template—spreadsheet or app—visualizes income and expenses. Categories like housing and savings enable targeted analysis. Regular reviews keep your budget aligned with goals.

Allocating Funds to Essential Needs

Prioritize housing, food, and utilities. An emergency fund for unexpected expenses is vital. Adjust allocations as circumstances change.

Setting Financial Goals

Align your budget with SMART goals—saving for a house, paying debt, or retirement. Long-term goals require dedicated strategies integrated into your plan.

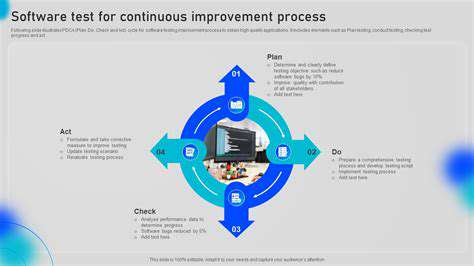

Monitoring and Adjusting Your Budget

Regularly compare actual spending to budgeted amounts. Adapt to life changes—job shifts, new expenses—to maintain financial relevance.

Food and Activities: Fueling Your Adventure on a Dime

Savoring Delicious Eats on a Shoestring

Local markets and street food offer authentic, affordable cuisine. Pack meals for remote areas to cut costs. This balances budget and cultural immersion.

Budget-Friendly Adventures: Maximizing Your Fun

Free activities—hiking, walking tours, local festivals—deliver rich experiences without high costs. Public transportation or carpooling further reduces expenses.

Read more about Budgeting for Epic Adventures: A Practical Guide

Hot Recommendations

- Senior Travel Discounts and Deals

- Personalized Travel for Different Seasons and Climates

- Honeymoon Destinations: Romantic Getaways for Newlyweds

- Mythical Places: Journeys to Legendary Locales

- The Future of Travel Agents in an Automated World

- Sustainable Design for Tourist Infrastructure

- Combatting Illegal Wildlife Trade Through Travel Awareness

- The Best Beaches for Relaxation and Sunbathing

- Marine Conservation: Diving into Responsible Ocean Travel

- Measuring the Social Impact of Tourism