Smart Contracts for Automated Refunds and Compensation

Mitigating Disputes and Improving Efficiency

Dispute Resolution Mechanisms

Implementing robust dispute resolution mechanisms within smart contracts is crucial for ensuring smooth transactions and minimizing the potential for conflicts. These mechanisms should be clearly defined and accessible to all parties involved, outlining specific procedures for escalating concerns and resolving disagreements. This transparency fosters trust and encourages amicable settlements before disputes escalate into lengthy and costly legal battles. Early intervention and clear protocols can prevent protracted legal processes, significantly improving overall efficiency and user experience.

A key component of effective dispute resolution is the ability to quickly and fairly assess the validity of claims. This often involves incorporating automated checks and verifiable evidence within the smart contract's code. For example, a smart contract for an online marketplace could automatically verify the delivery status of a product or the completion of a service. This automated verification process helps prevent false claims and streamline the resolution process, significantly improving efficiency and reducing the need for manual intervention.

Automated Refund Processes

Smart contracts excel at automating the refund process. By pre-programming the conditions for a refund, the system can trigger the release of funds automatically upon the occurrence of a pre-defined event, such as non-delivery of a product or dissatisfaction with a service. This automated approach ensures timely refunds, significantly reducing the time required for manual intervention and improving the user experience. For example, in an e-commerce setting, a smart contract could automatically refund the customer's payment if the order is not fulfilled within a specified timeframe, eliminating the need for lengthy customer service interactions.

This automation also reduces the potential for human error in processing refunds. Manual processes are prone to mistakes, delays, and inconsistencies. Smart contracts, on the other hand, execute predefined logic without human intervention, ensuring consistent and accurate processing of refunds. This automation not only improves efficiency but also enhances trust and transparency for all parties involved in the transaction.

Improving Efficiency Through Transparency

Smart contracts' inherent transparency is a powerful tool for mitigating disputes and improving efficiency. All parties involved can easily access and verify the terms of the agreement, the execution of the contract, and the status of any dispute resolution process. This transparency fosters trust and reduces ambiguity, making it easier to identify and resolve any discrepancies quickly and efficiently. By providing clear and accessible information about the transaction, smart contracts eliminate guesswork and increase accountability.

Enhancing User Experience

A streamlined and automated refund process, facilitated by smart contracts, significantly enhances the overall user experience. Users benefit from faster resolution times, reduced frustration, and increased trust in the platform. The elimination of manual intervention and potential delays minimizes the friction associated with traditional dispute resolution processes. This positive user experience contributes to customer satisfaction and encourages repeat business, ultimately driving the success of any platform leveraging smart contract technology for refunds.

Future Applications and Opportunities

Automated Dispute Resolution

Smart contracts can automate the process of dispute resolution in various transactions. By incorporating predefined conditions and triggers, the contract can automatically initiate a refund process if certain criteria are met, such as a product not meeting the agreed-upon specifications or a service not being delivered as promised. This eliminates the need for lengthy and costly legal processes, resulting in faster and more efficient resolution for both parties involved. This automation also reduces the potential for human error and bias in the decision-making process, promoting fairness and transparency in the dispute resolution phase.

Streamlined Refund Processes

Imagine a system where refunds are initiated automatically based on predefined conditions. Smart contracts can be programmed to trigger a refund when a customer returns a product, providing a seamless and efficient process. This eliminates the need for manual intervention, reducing delays and administrative burdens. Furthermore, smart contract technology can ensure that refunds are processed according to the agreed-upon terms, minimizing disputes and enhancing customer satisfaction.

The automation of refunds using smart contracts also allows for greater flexibility in terms of refund policies and conditions. Businesses can create customized refund procedures tailored to specific products or services, ensuring that customers receive refunds in a manner that aligns with their expectations.

Enhanced Customer Experience

Implementing smart contracts for automated refunds significantly enhances the customer experience. Customers will appreciate the speed and efficiency of the process, leading to greater satisfaction and loyalty. The transparency and clarity provided by smart contracts build trust and confidence in the business, further bolstering the customer relationship. By handling refunds swiftly and efficiently, businesses can focus on providing exceptional customer service in other areas.

Supply Chain Optimization

Beyond retail, smart contracts can revolutionize supply chain management by automating refunds for defective products or delayed deliveries. Using predefined conditions, the contract can automatically initiate a refund process when a product fails quality checks or delivery deadlines are missed. This optimization streamlines the entire supply chain, minimizing disruptions and improving overall efficiency. This level of automation is crucial for reducing costs and improving profitability in a competitive marketplace.

Global Accessibility and Scalability

Smart contracts have the potential to significantly improve the accessibility and scalability of refund processes. By leveraging blockchain technology, these contracts can operate across borders and time zones, enabling businesses to process refunds globally without geographic limitations. This feature is critical for businesses operating in a global market, facilitating seamless transactions and offering a consistent customer experience regardless of location. The decentralized nature of blockchain enhances transparency and trust, fostering confidence in the system for all parties involved.

Read more about Smart Contracts for Automated Refunds and Compensation

Hot Recommendations

- Senior Travel Discounts and Deals

- Personalized Travel for Different Seasons and Climates

- Honeymoon Destinations: Romantic Getaways for Newlyweds

- Mythical Places: Journeys to Legendary Locales

- The Future of Travel Agents in an Automated World

- Sustainable Design for Tourist Infrastructure

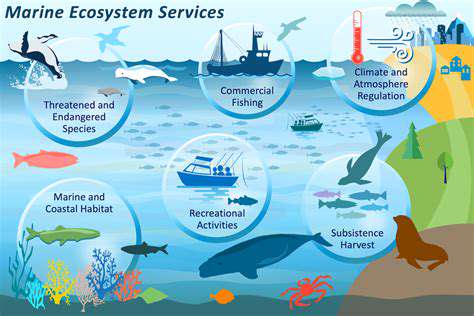

- Combatting Illegal Wildlife Trade Through Travel Awareness

- The Best Beaches for Relaxation and Sunbathing

- Marine Conservation: Diving into Responsible Ocean Travel

- Measuring the Social Impact of Tourism